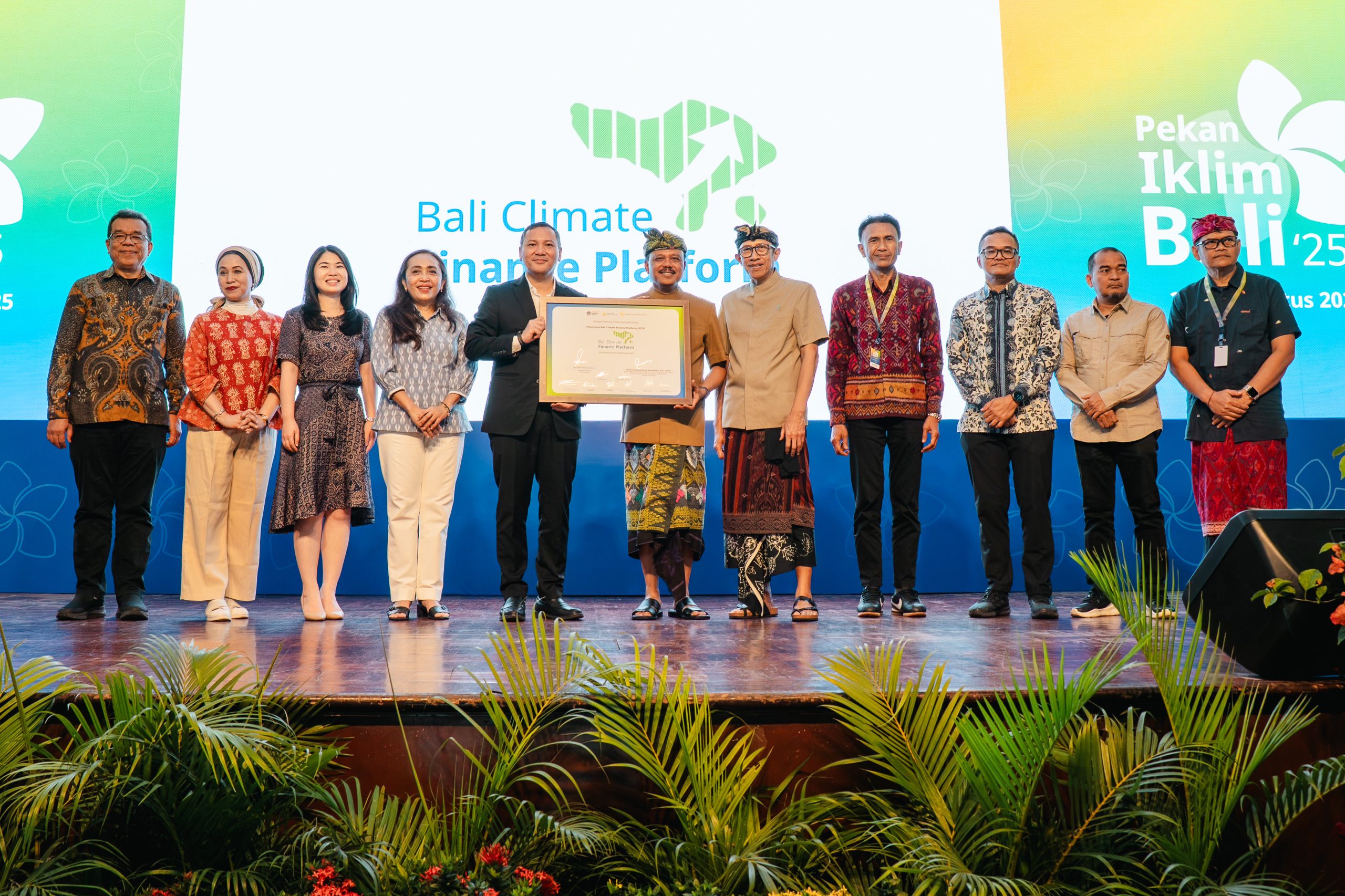

Denpasar, 28 August 2025 – Bali is taking a decisive step in aligning finance with climate ambition. At the Forum Investasi Iklim, held as part of Bali Climate Week 2025, the Provincial Government officially launched the Bali Climate Financing Platform (BCFP), a mechanism designed to mobilize investment into low-carbon and climate-resilient projects across the island.

The platform aims to bridge local initiatives with national and international funding, connecting government, project developers, financial institutions, and investors in one ecosystem. By doing so, clean energy, low-emission transport, and nature-based solutions will have clearer pathways to financing and implementation.

The launch comes amid a pressing financing gap. According to Rachmat Kaimuddin, Deputy for Infrastructure and Regional Development at the Coordinating Ministry for Maritime Affairs and Investment, Indonesia requires nearly IDR 4 trillion in climate transition investment by 2030. Public budgets can only cover about a third.

Bali’s commitment to climate financing builds on its broader agenda of economic transformation. Bappenas, through Ministerial Decree No.109/2023, formed the PMO Transformasi Ekonomi Kerthi Bali to oversee the BCFP and ensure alignment with the province’s six economic transformation agendas.

The platform is backed by several key financial institutions, including the Environmental Fund Management Agency, PT Sarana Multi Infrastruktur, HSBC Indonesia, Maybank Indonesia, and JETP Indonesia.

The conversation extended beyond financing to the intersection of climate action and economic regeneration. Suzanty Sitorus, Executive Director of ViriyaENB, called on local leaders to adopt regenerative economic models:

Water security was also highlighted as a critical dimension of climate resilience. Retno Marsudi, UN Special Envoy for Water, joined Nirarta Samadhi, Indonesia Director of WRI, in a panel on the role of international financing in strengthening local adaptation strategies.

Nirarta, who also serves as a Steering Committee Member of the Bali Net Zero Emissions Coalition, concluded:

The launch of BCFP underscores Bali’s intent to move from pledges to practice. More than a funding mechanism, it is designed as a policy lever that aligns government priorities with private capital, ensuring climate goals translate into implementable projects that safeguard both livelihoods and landscapes.